Craggle

An innovative crowdsourcing platform to give Australians a better home loan rate

Craggle is a new-to-market, crowd-based platform that provides homeowners a way to renegotiate their current home loan with multiple banks using the power of the crowd as a negotiating tool

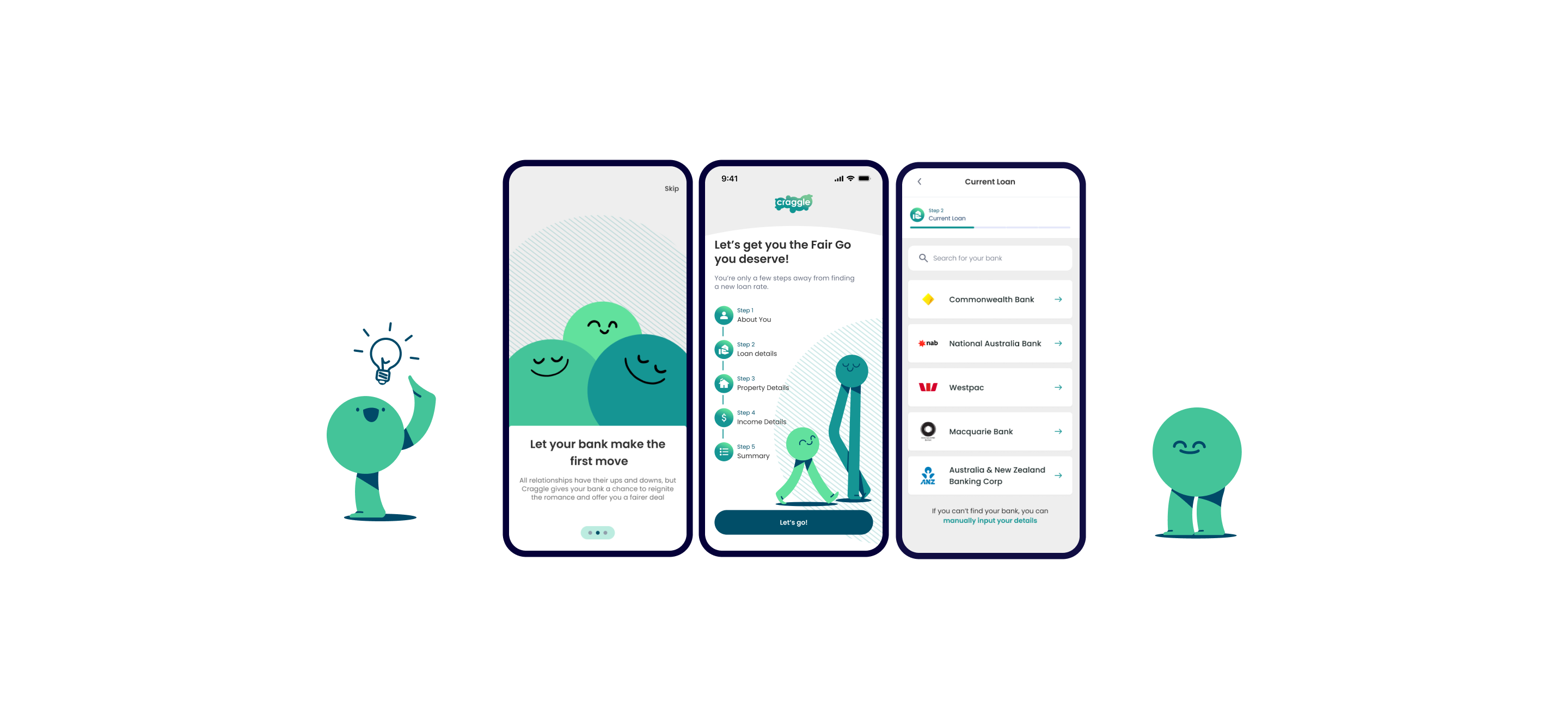

All-new bespoke customer onboarding platform designed to drive conversion

Delivery of the marketing website (the ‘home of’ Craggle) whereby humans can experience the brand story as well as tools and tips

Delivery of lender (banks) platform to facilitate loan acceptance for customers

Proprietary research validating the business idea, educating the user experience and affirming the product value

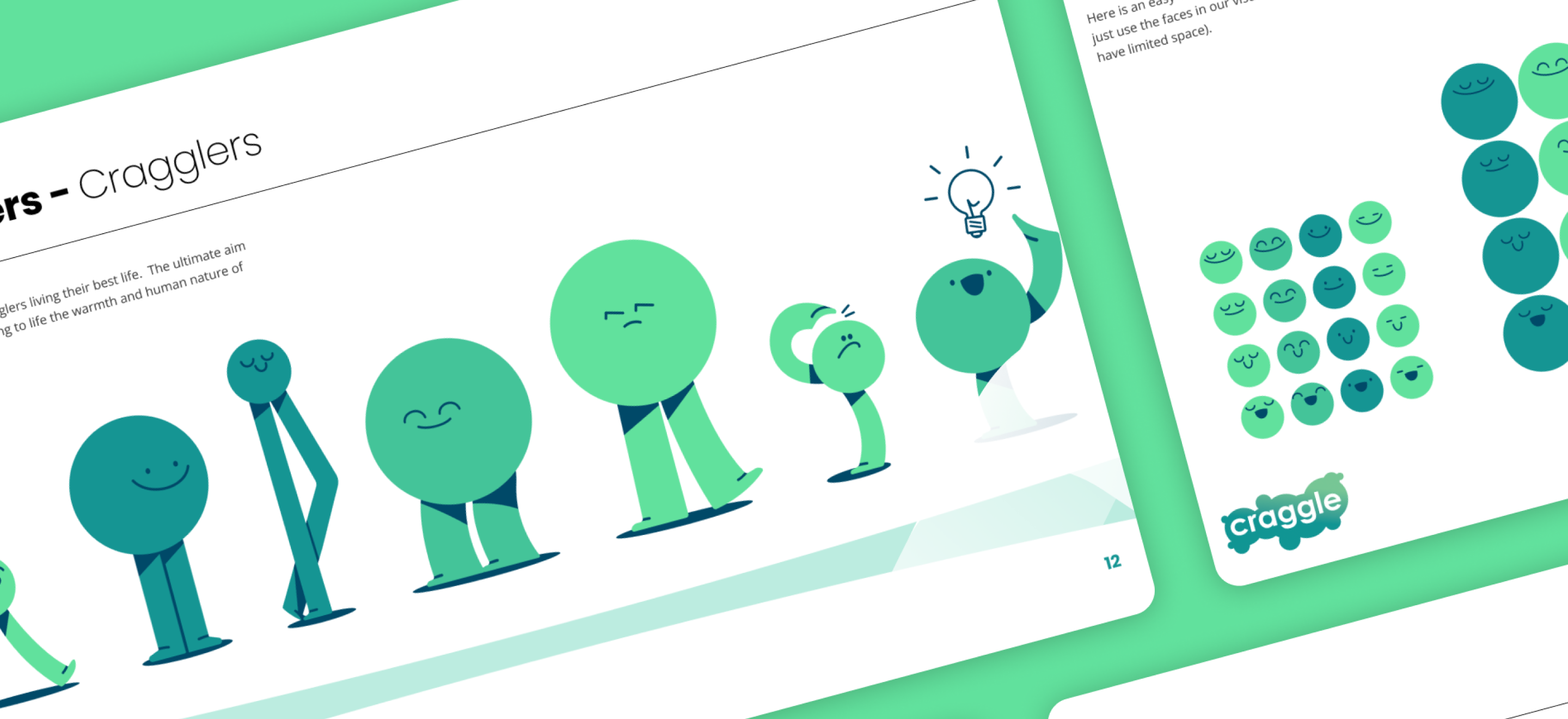

A full ‘human-first’ brand strategy and egalitarian brand design, tone and creative work

The situation

Against a backdrop of rising interest rates and many Aussies about to face financial difficulties rolling from low (Covid era) fixed rates into this new situation, Craggle identified an opportunity to shake up the stagnant Australian home-loan market. By creating a Crowd-Haggling platform whereby consumers could group together to use the might of their combined loan value to negotiate a better deal either with their existing financial provider or ‘go to market’ to gain a better one. LDN worked with the Craggle team to bring this concept to life, uncover the business they are really in (a Fair Go for all) and build the first crowd based home loan negotiation tool on the market.

Hypothesis

Customers and the banks alike will welcome this ‘new’ product that empowers thousands of Australians to negotiate fairly with the home loan market. By creating a simple onboarding process, eliminating any blockers, building a likable brand and showing the value of Craggle ( a Fair Go for al!), this product will only be met with a rapid uptake in conversions.

The objective

Research

Uncover macro and micro level actionable human insights that support us in defining the problem we are solving, creating a brand that will resonate and building a first-in-market product that is embraced by all.

Create

Adopt a process that will enable us to build a large scale digital product enabling an end to end agile workflow across multiple HX disciplines, and a human-friendly brand to match.

The process

Stakeholder workshops

We conducted a series of problem framing workshops with key stakeholders to understand, define and prioritise business and human problems. These workshops helped the team get a better understanding of the business purpose, ambition and to align priorities. We adopted a phased approach across research, design and development to ensure we left space to test and learn, enabling a speedier iteration of each product feature.

Research

A thorough dive into the home loan space, alongside a full competitor analysis / as well as deep dive into the market, helped identify that the only distant competitors to Craggle where ‘the aggregators’. As this business model was also distinct from the Craggle ‘people power’ model we could create a stand alone market positioning. Off the back of this we built personas which enabled a focused decision making process by building empathy for the end user.

Customer Interviews

We conducted in-depth one-on-one interviews with a mixed demographic across Australia. The purpose of our interviews was to understand the value proposition, trust, and user experience and, in turn, quickly understand the need for such a product on the market. We conducted the sessions using a clickable prototype as stimulus and recorded the session to capture real verbatim, usability feedback of the ‘initial’ experience, and overall view of the proposition. This was a great opportunity to present the brand proposition and the Craggle characters (created by Raise) which enabled a quick iteration of all brand properties.

Product design to scale

Once we had the green light to go ahead (post validation stages) we jumped into a sprint-based format which allowed us to build and test features. We build out all customer flows for the onboarding process, the offer process and the ‘hand shake’ between the customer and the bank. By also building a platform for lenders (banks) to access and accept customer applications, and view customer insights and data was the glue that held the experience together.

By building out design systems that enable quick scale for new features, user flows and updates we are enabled to simply adapt the experience as customers and lenders needs change.

Brand and Tech hand in hand

As part of a commitment to a holistic human experience, LDN led the complete brand strategy work for Craggle and created a visual brand language and written tone (and creative content) ensuring this was fully utilised across early prototypes and of course in the final web app and marketing materials.

Consulting and support

At every stage we were an integral part of the Craggle Team. We were a key part of bank partner presentations including presentation documents, meetings and Q&A’s. Likewise we were an integral part of ensuring the human experience of Craggle was captured in investor presentations.

We supported the first launch of Craggle to the market and enabled a test and learn workflow where we can ‘fix’ any initial customer issues post launch.

Case studies

A smarter digital experience increasing online quotes

With QBE Insurance

A digital transformation to increase student room bookings

With Campus Living Villages