qbe insurance

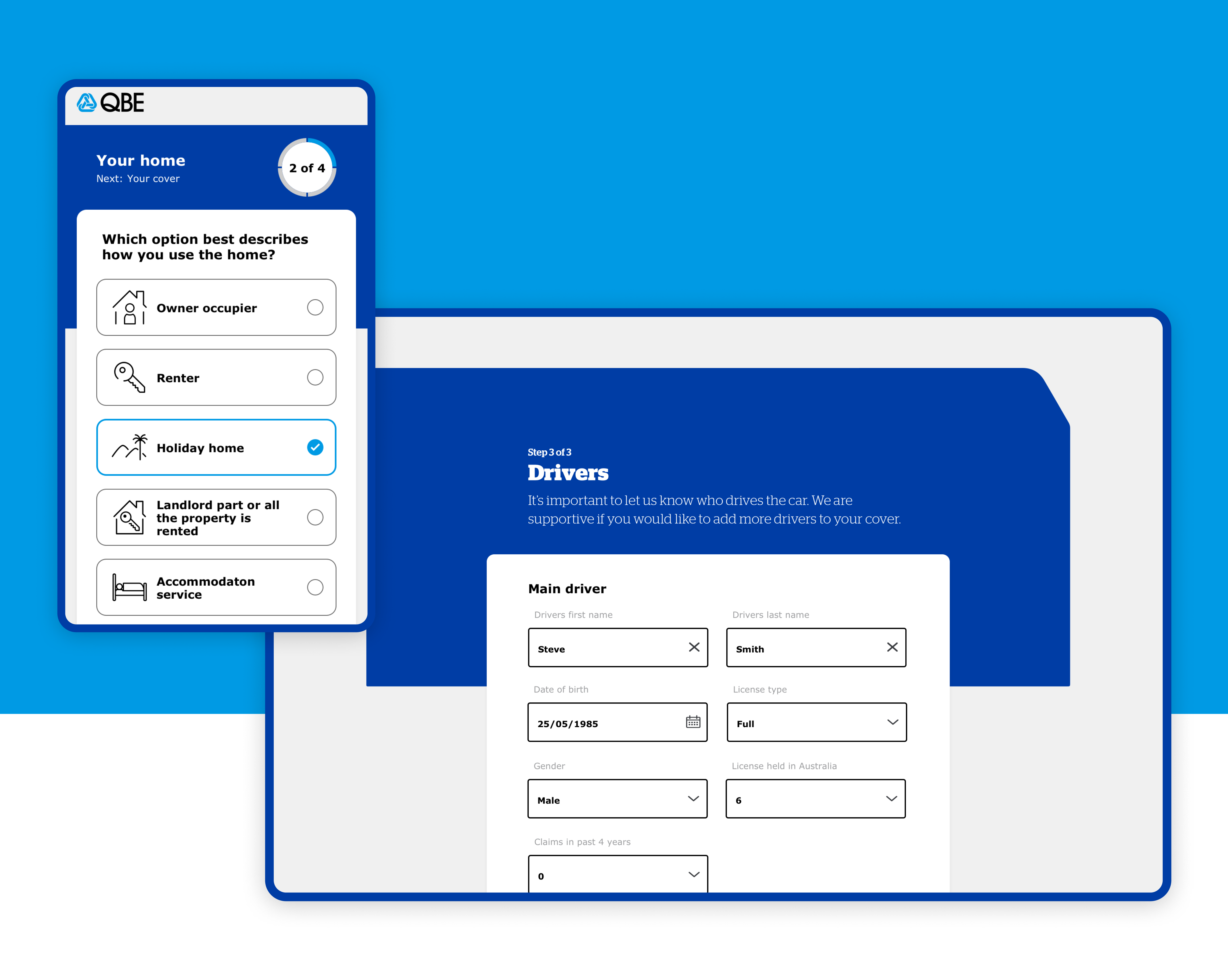

a digital platform to allow QBE's trustworthy status to shine through

QBE is one of the world’s top 20 insurance companies, located in 37 countries. It has been listed on the Australian Securities Exchange since 1973

Streamlined experience nestled under the key driver of ‘protecting the things that matter’

Simplified the experience with more transparency in price and product

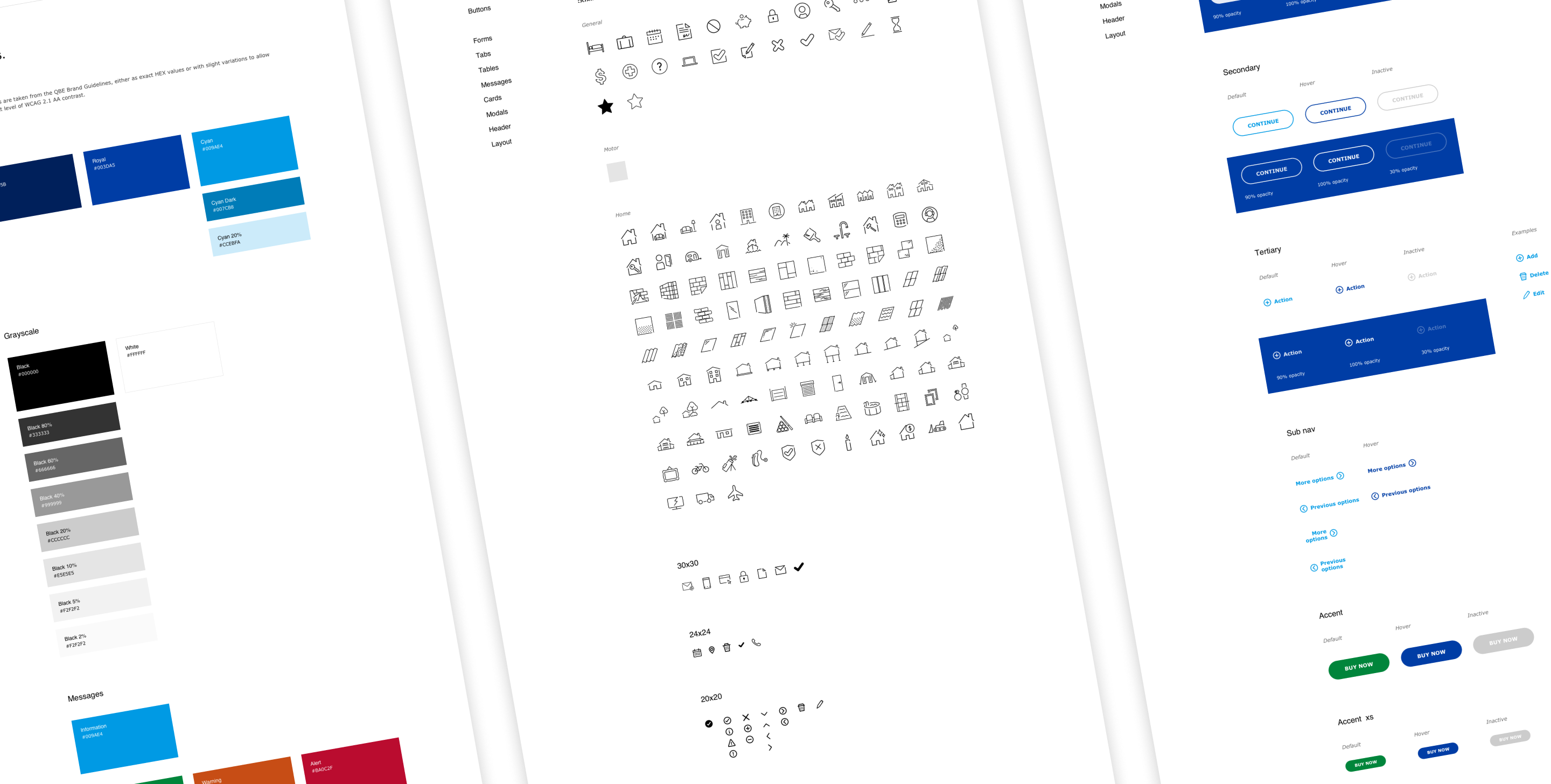

Created a broader Design System enabling rapid development

Easy access to ‘members’ area for claims and questions

Close liaison with QBE legal and product teams to reduce the quote time process

Expanded to a wider remit to ensure the ‘wrap-around’ process was efficient

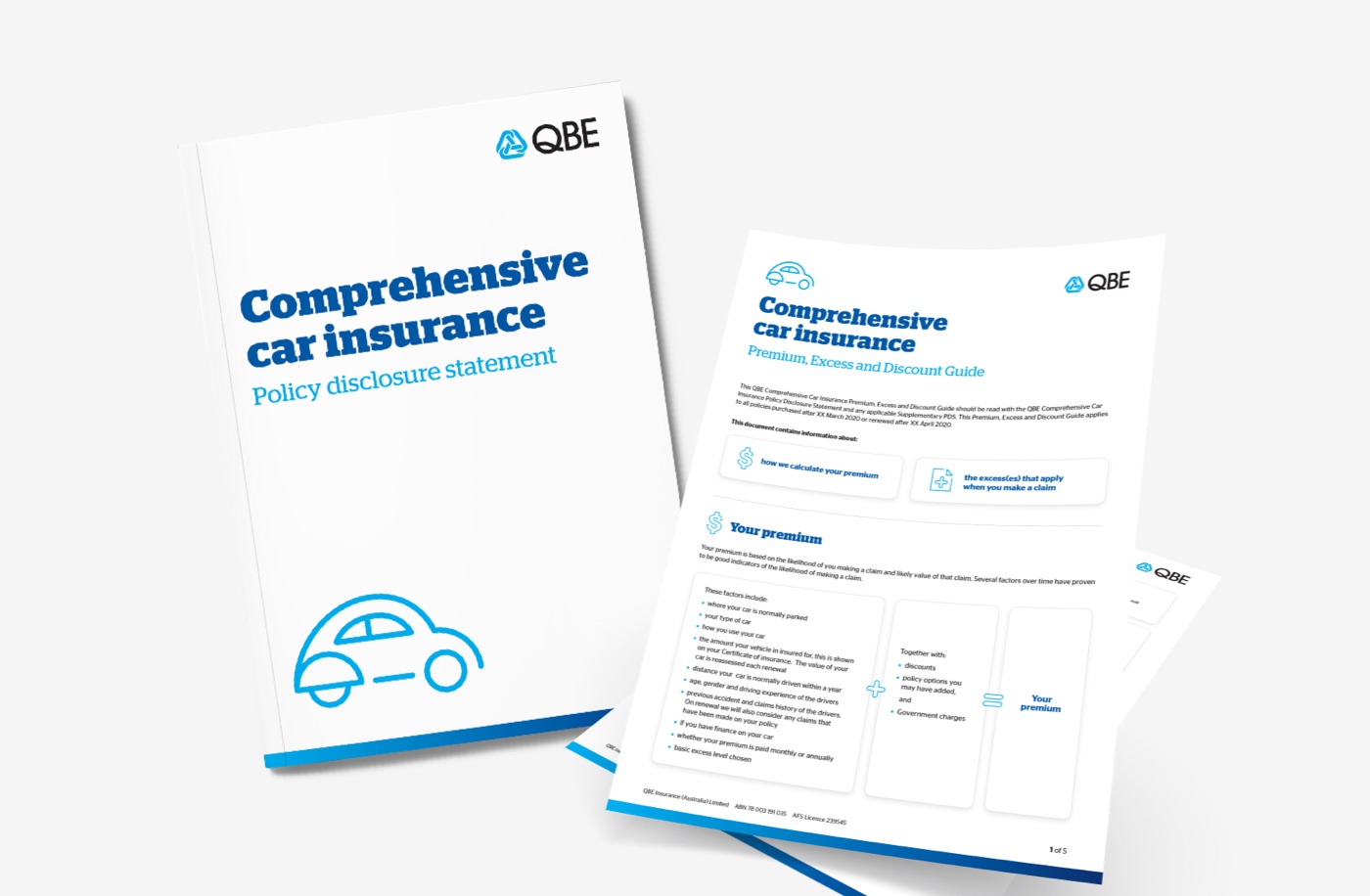

Customer documents and emails comms were also tested and optimised for simplicity

the situation

QBE were experiencing a decline in insurance policy sales and low conversions from their online insurance quote experience. LDN were engaged to help discover why customers were dropping off and to design a better performing digital experience across multiple insurance products.

the objective

A customer-centric digital experience, that ‘cuts through the clutter’, allows customers to easily navigate and, ultimately, contributes to increased conversion rates and customer satisfaction with the process.

the process

LDN’s gap research was employed via extensive stakeholder interviews, customer interviews and call-centre shadowing. Research investigated what factors made buying insurance a challenge. The gap process included:

Business (QBE’s world)

With a proliferation of research products offered and a website that had endured ‘add-on’s the business acknowledged this ‘shop window’ was sub-optimal. Not only was the process confusing but the brand experience was unsatisfactory. Each product division within QBE had an in- depth understanding of the key benefits of their stream of insurance, however this was getting lost when each stream was placed together on the existing website. Customers that had tried to navigate the website expressed frustration when speaking to call-centre teams, creating a knock-on effect of low morale in this team.

Human (real-world customers)

It was discovered that customers found QBE insurance jargon confusing and that there was a distinct lack of trust in their online insurance quote process. Customers were looking for more transparency in pricing and product. During the UX and UI design stages, customer testing revealed a consistent need to optimise the online quote experience for simplicity and speed. The challenge was set to minimise insurance jargon, reduce the numbers of questions asked and remove any UI components that were not facilitating faster completion!

Environment (big wide world)

At the time of the project Australia had experienced fires, then floods in a timeframe that was shocking and scary for many. Media presented horror stories about claims not being paid out and ‘small print’ ruining lives

The gap

This is a snapshot of the insights identified through the research process. This project was so timely, and informative that we actually provided several ‘gap’ iterations for the client to create ongoing internal workstreams as desired! Our personal security / safety, planet, and trust-levels seemed very much under-threat.

the outcome

- Increase in sales conversion rates of 500% in the first 6 months

- Reduction in the number of questions asked during the quote process from 18 to 10; helping save customers time and create greater call-centre efficiencies

- Prompted review of entire customer communication journey

1

business

QBE has a plethora of proof points, accolades, and heritage to underpin a worthy product offering, once we strip away the confusion we can let this shine.

2

human

Care for ourselves, loved ones, and (to an extent) planet, is a priority. But we want to feel that we are the ones in control and fully educated to know we are making the right decision.

3

environment

Against a growing backdrop of distrust, disaster and time pressure third party assurance, clear proof points, a ‘straight up’ approach , and a commitment to care, make all the difference.

4

gap

QBE is best placed to assist Aussies as they endeavour to protect the things that matter, and we will do so by empowering them to make easy and informed insurance research through to purchase.

case studies

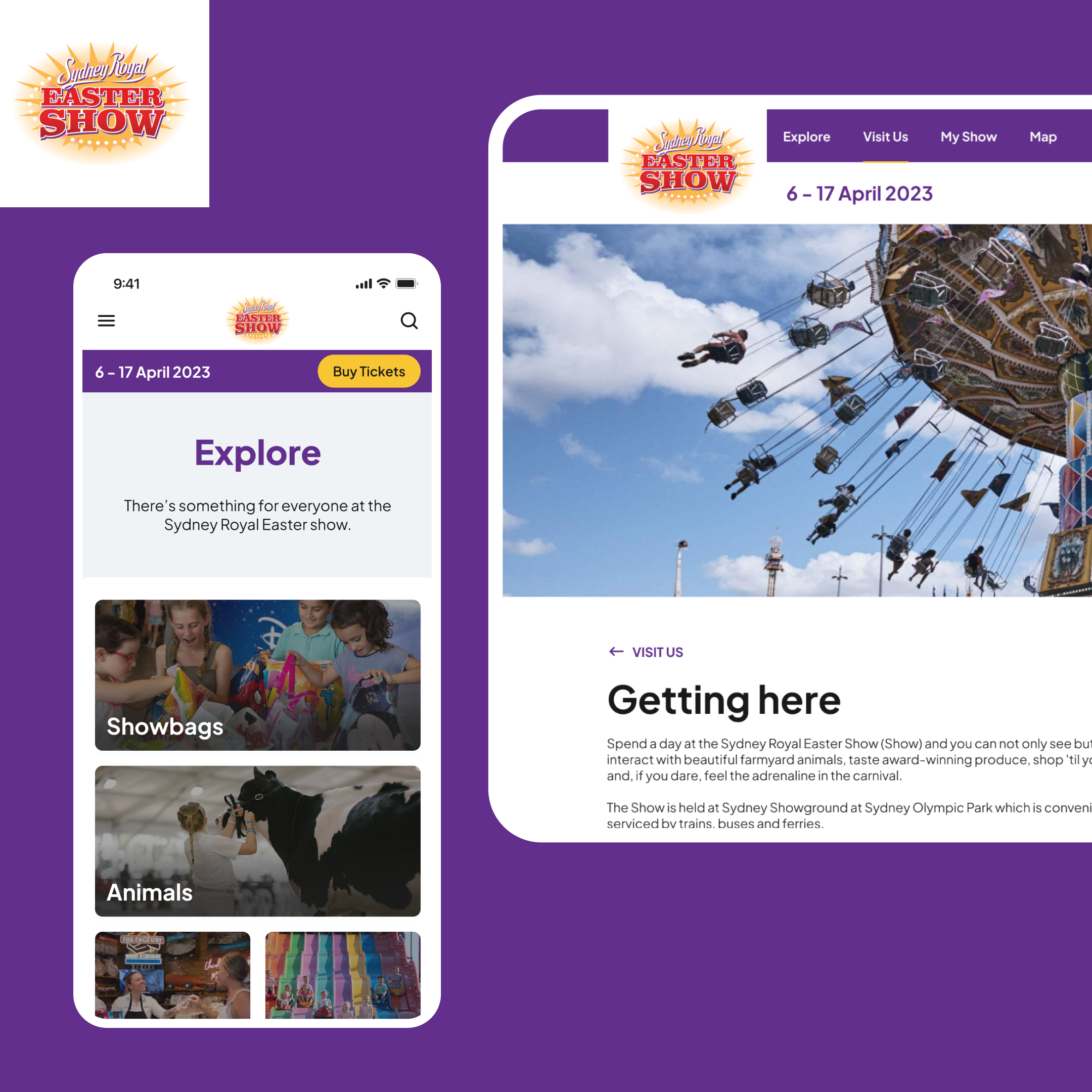

a new home for Australia’s largest ticketed event

With Sydney Royal Easter Show

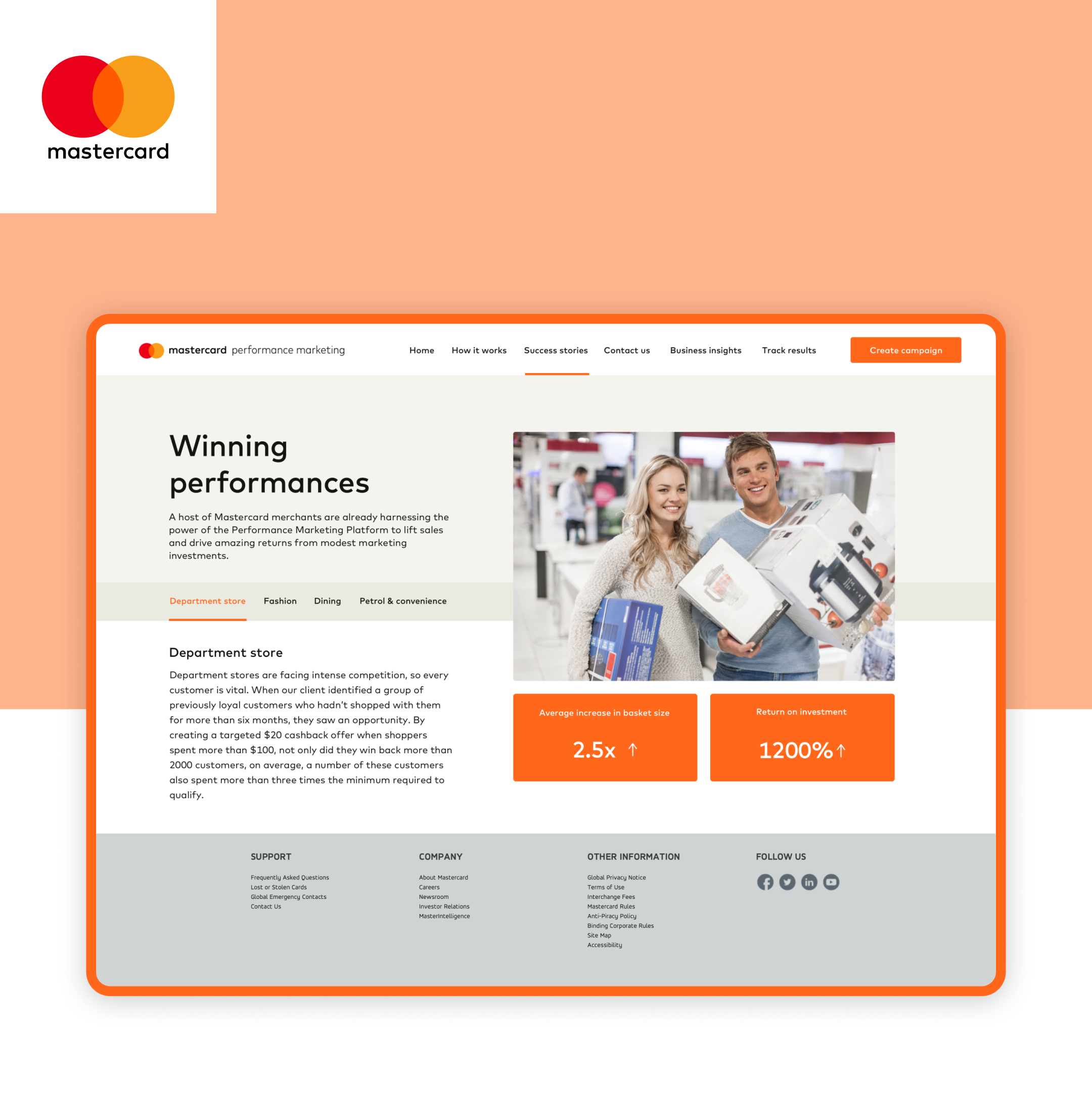

a marketing platform empowering merchants to increase sales

with mastercard